Free trial

159 €/month

Dynamics 365 Business Central

Dynamics NAV

https://docs.idynamics.es

iDynamics SII

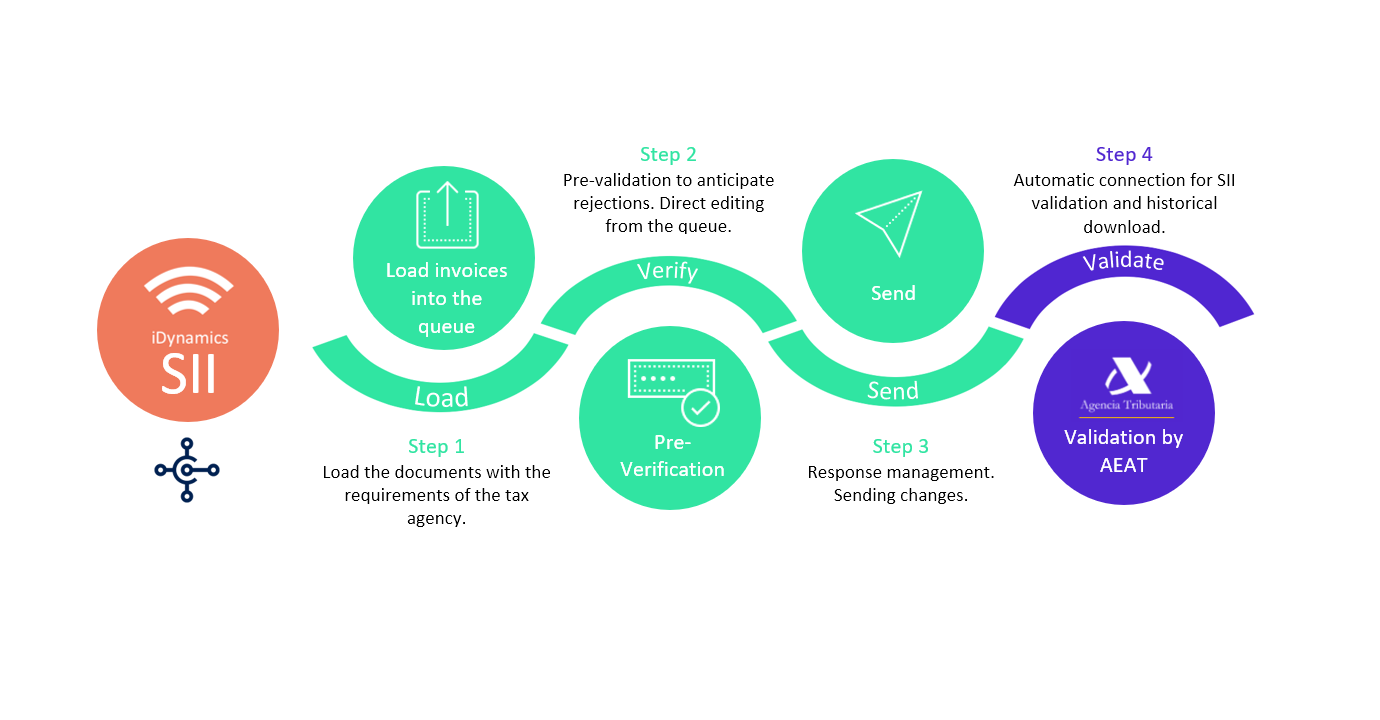

Comply with the VAT presentation directly from your management software.

Does the standard SII integration of Microsoft Dynamics 365 Business Central not cover all your needs? Would you like to verify if there are discrepancies between what you sent and what the credit/debtor reported to AEAT?

It is the perfect solution for those customers who are not covered by the standard functionality included in Dynamics 365 Business Central, or who want a tool that provides them with more flexibility and information about the data that is being sent or that has been stored in the Tax Agency.

Features and benefits

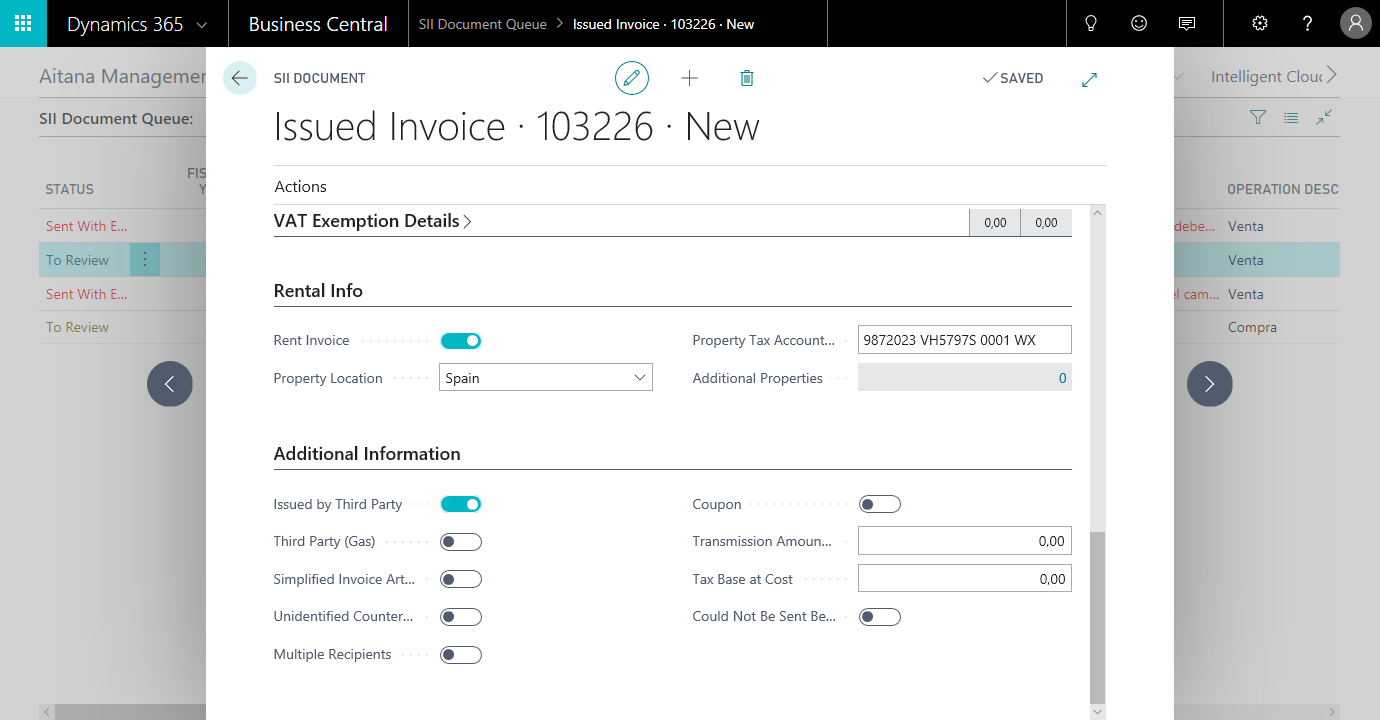

- It supports all the types of messages offered by the AEAT SII service, including, among others, information related to rentals, travel agency and insurance operations, consigned goods and investment goods.

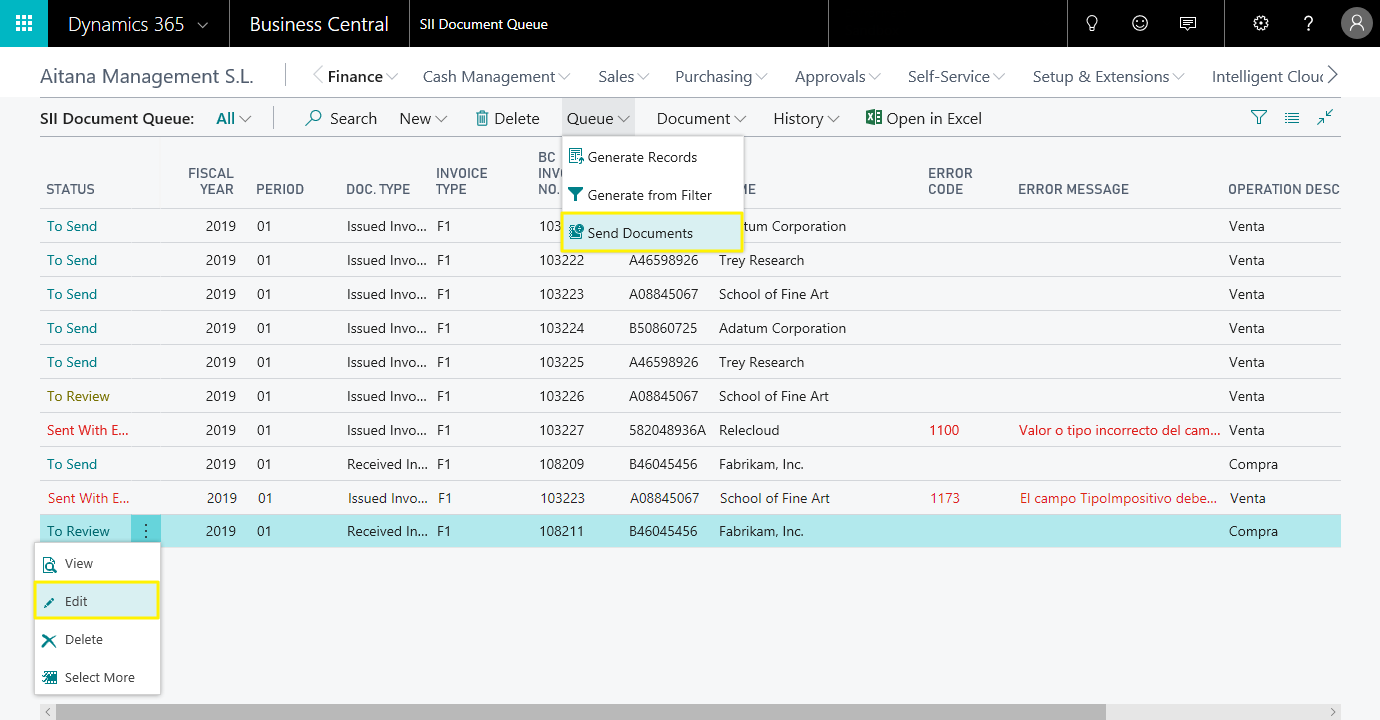

- It allows reviewing and editing the information that is sent to the SII service.

- Validation of VAT numbers of Spanish customers and vendors in the Tax Agency (AEAT).

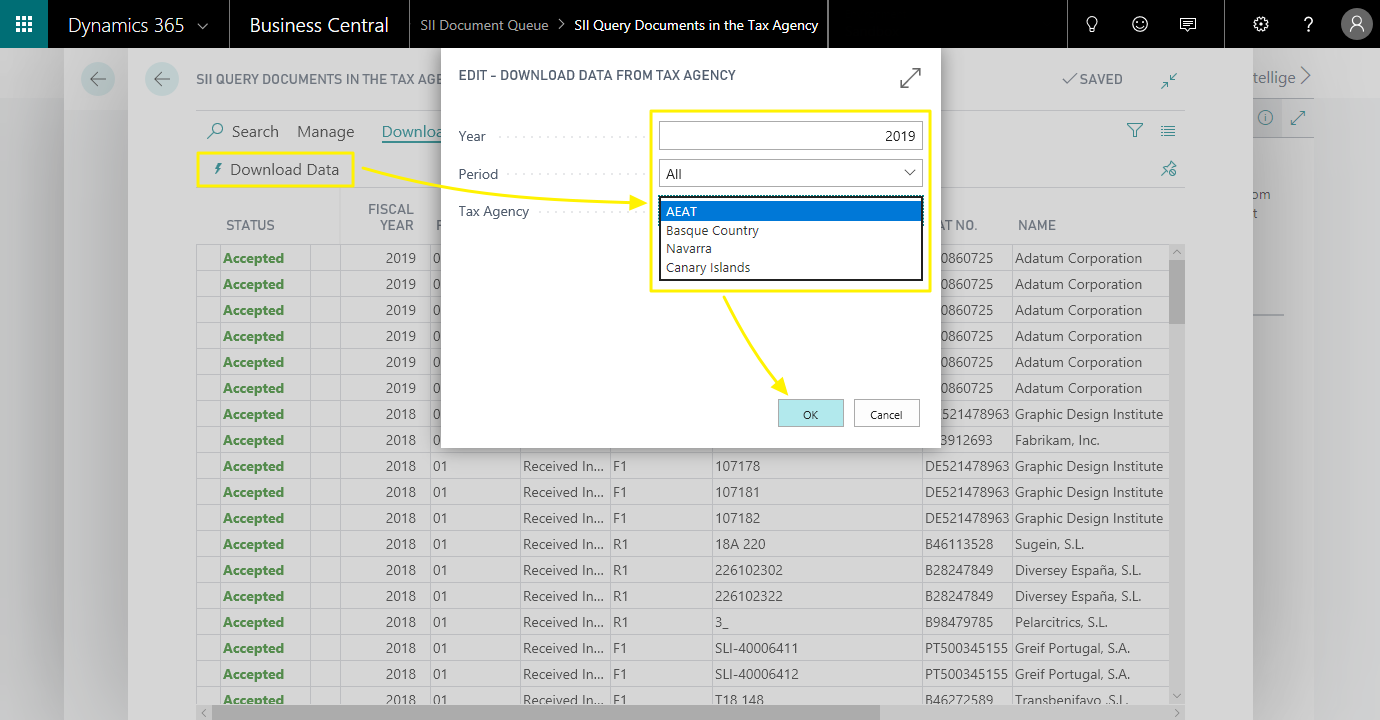

- Invoices can be notified to the different Spanish tax agencies, depending on the VAT posting groups.

- Check the information that the tax agency has about your company, regardless of whether it was sent from Dynamics 365 Business Central, from a different application, or entered manually through the tax agency portal.

- If there were any errors in the information sent, easily create update requests with the correct data.

- Supports the peculiarities related to the IGIC service of the SII of the Canary Islands.

- Supports all special regime operations, including code 17 for internet sales (Single window – OSS)

Download iDynamics SII now and take advantage of the customization and shipping management facilitates that are added to your Business Central!

Free trial

159 €/month

Dynamics 365 Business Central

Dynamics NAV

https://docs.idynamics.es